About The System

An accounting system allows a business to keep track of all types of financial transactions, including purchases (expenses), sales (invoices and income), liabilities (funding, accounts payable), etc. and is capable of generating comprehensive statistical reports that provide management or interested parties with a clear set of data to aid in the decision-making process. Today, the system used by a company is generally automated and computer-based, using specialised software and/or cloud-based services. However, historically, accounting systems were a complex series of manual calculations and balances.

What The Accounting System Manages?

1- Expenses :The amount of cash that flows out of the company in exchange for goods or services from another person or company are the expenses. In older accounting software or with a manual system such as Excel, it is necessary to manually enter, balance, and categorise each expense. An automatic accounting system allows quick entry, categorisation and automatic balance of expenses.

2- Invoices :Creating a professional looking invoice is an important part of developing a positive brand image and building confidence with customers. Today, some accounting systems such as CIBS allow for instant invoice creation with the ability to customise and automatically keep track of paid invoices and income.

3- Funding :All the business liabilities, whether accounts payable, bank loans taken to support the business, or mortgages, etc. An accounting system keeps track of these liabilities as payable values and automatically updates the balances as soon a payment is made and accounts are settled.

Features of the program

-

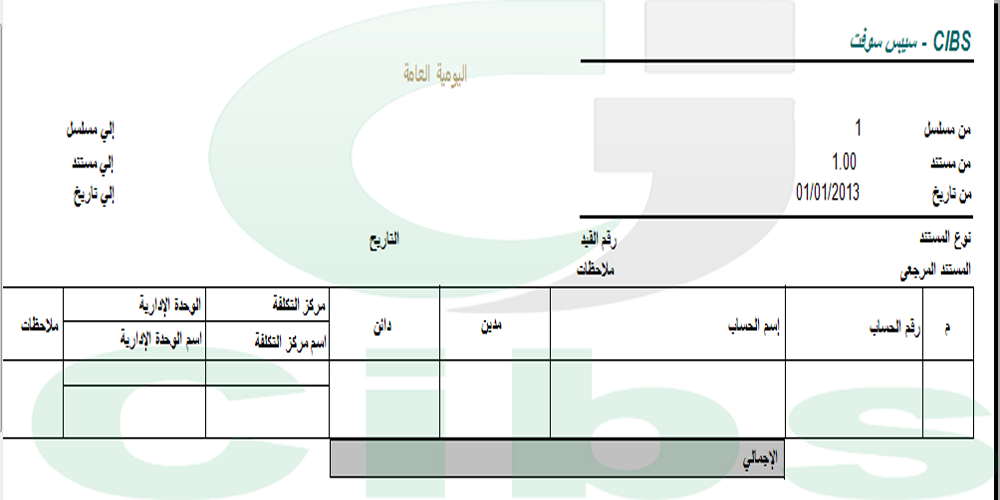

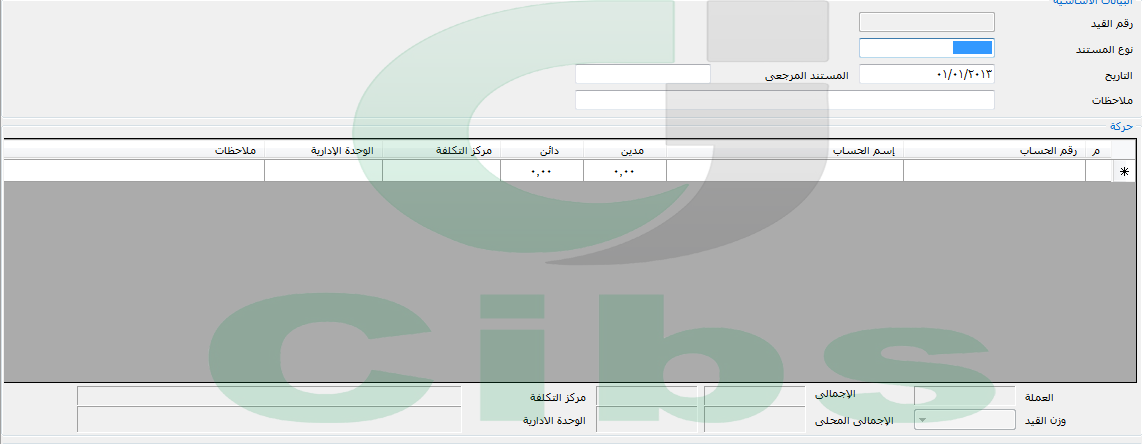

Jurnal voucher :

- Is a compilation of the daily restrictions resulting from the editing of documents in all parts of the program to obtain all the financial information and reports, such as: Assistant Professor - General Secretary - Balance of Audit - Budget ... etc

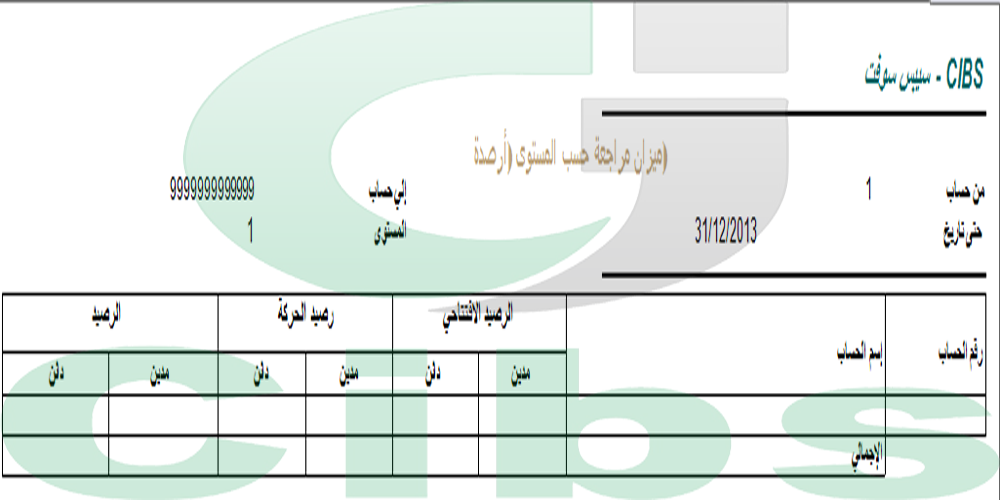

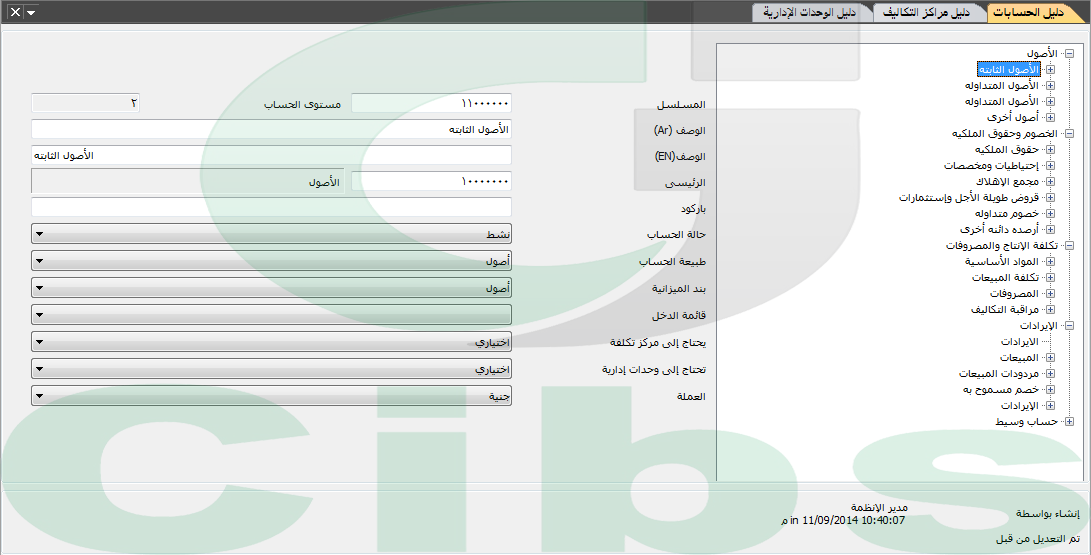

- The accounts tree is compiled and categorized in terms of accounting classification and accounting guidance for the budget or income lists. It works on an unlimited number of levels. The accounts directory is the backbone of the accounting system, which is dependent on all the programs related to the accounting system so that the concept of ERP or integration system

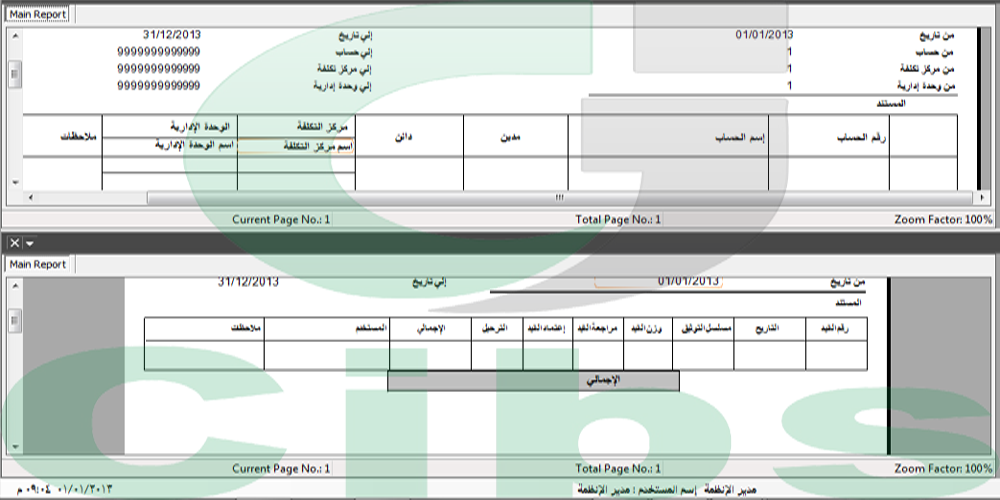

- The administrative units directory acts as the auxiliary accounts for the supporting accounts. The system allows for the allocation of the accounts of the administrative units with the cost centers on all accounts according to the accounting guidance details.

- The Cost Centers directory acts as the assistance Accounts,the Account directory can be classified as assistance Accounts and Cost Centers Also, the process of analysis of calculations that enable us to view account details, and the system allows the possibility of allocating the accounts of the cost centers on all accounts according to accounting guidance. It is the beginning of the steps taken by the decision-makers.

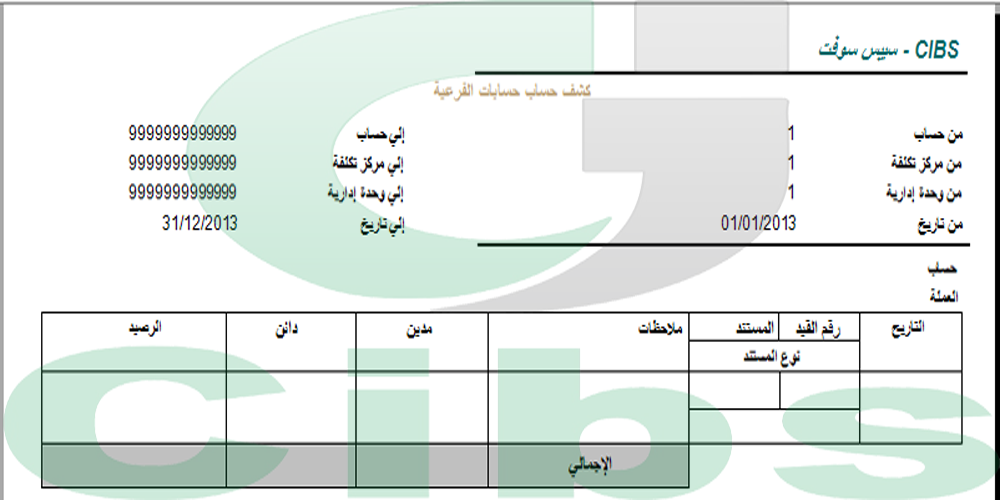

- A comparative analysis of the value of the sub-account and its proportion of the total accounts. For the same account between current and previous years.

Accounts and assistance accounts such (cost centers directory and administrative units):

-

Cost Centers Directory:

Directory of Administrative Units :

Financial reports and final lists :